We are sure you follow us on this blog and our social media. In that case, you already know about the new Beneficial Ownership Information Report (BOI, BOIR) that the U.S. government is mandating starting in 2024 to all small business owners, including LLCs. You’re looking for ways to file your Beneficiary Information Report (BOI) and complete it as soon as possible. We know navigating the process can be overwhelming, but don’t worry! We’ve compiled a step-by-step guide to help you file your BOI successfully. (If you want to know about the Beneficial Ownership Information Report, here is an article on our blog.)

Why is important to report the Beneficial Ownership Information?

Step 1: Determine your filing deadline

The first step to filing a BOI is to know your filing deadline: Small businesses created or registered to do business in the United States before January 1, 2024, must file their return by January 1, 2025. Reporting companies created or registered to do business in the United States in 2024 must file within 90 days of the date the business was incorporated or within 60 days of making changes to your company’s articles of incorporation.

What category does your company fall into? We can say with certainty that most LLCs fall into the first category, meaning they will have until January 2025 to file the Beneficiary Ownership Information Report (BOI).

Step 2: Identify your beneficial owners.

Beneficial owners are individuals with significant ownership interest or control in your business. Beneficial owners refer to people who own more than 25% of their company’s shares or voting rights, as well as those who exercise significant control over the management of your company.

You should compile a list of all your beneficial owners, including their full legal name, date of birth, nationality, residential address, and the nature and extent of their interest in your business.

Step 3: Verify your identity

The next step is to verify the identity of your beneficial owners. You should collect and verify identity documents, such as passports or national identification cards, to confirm their identity and be able to include them in the BOI form, as they are indispensable documents. Upload images of identification documents in JPEG or PDF format online.

Step 4: Complete the Report of Beneficiary Information (BOI) form

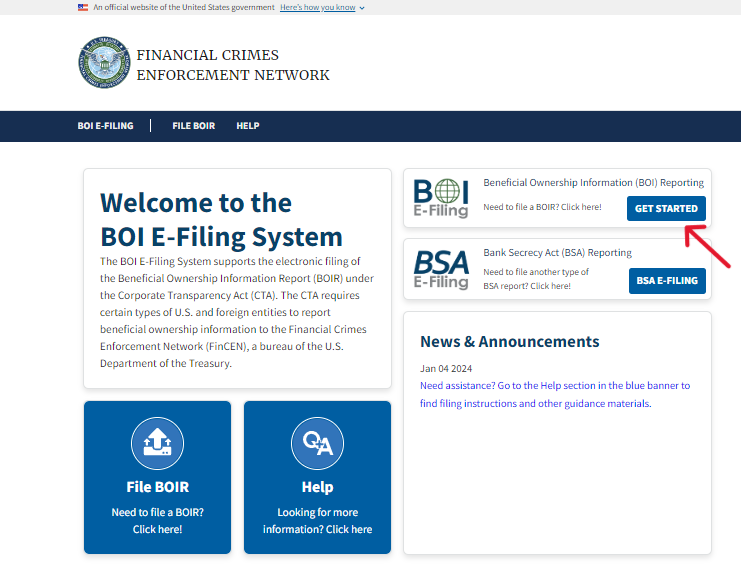

a) Start by visiting FinCEN’s official website https://www.fincen.gov/boi and click on the first FILE option as shown:

b) Then click on the button corresponding to BOI E-File:

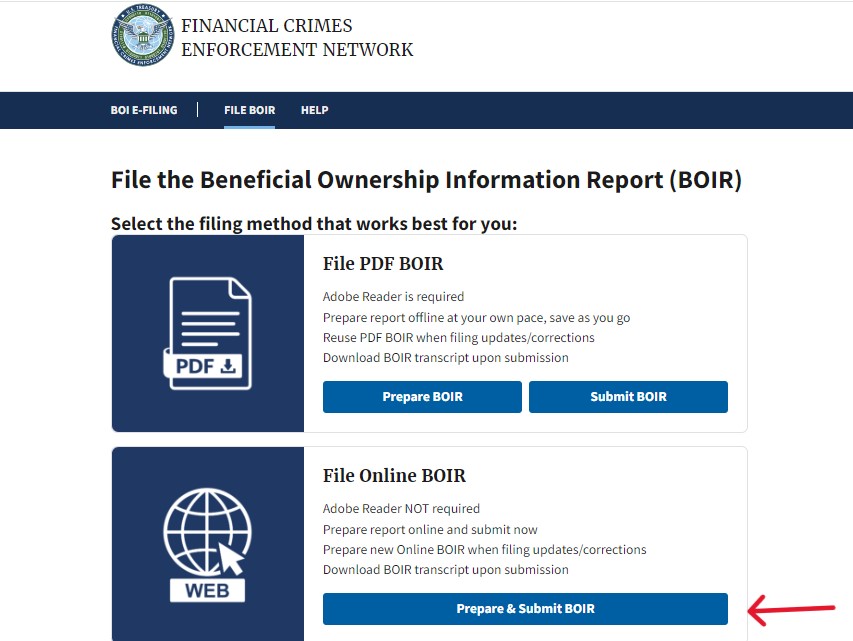

c) When selecting the filing method, choose the “File Online BOIR” button and click the “Prepare & Submit BOIR” button as shown:

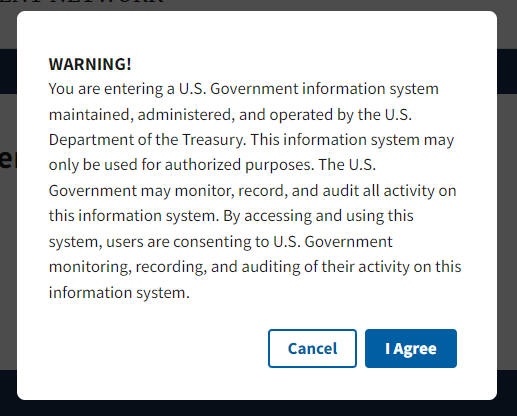

d) Read and agree in the warning pop-up:

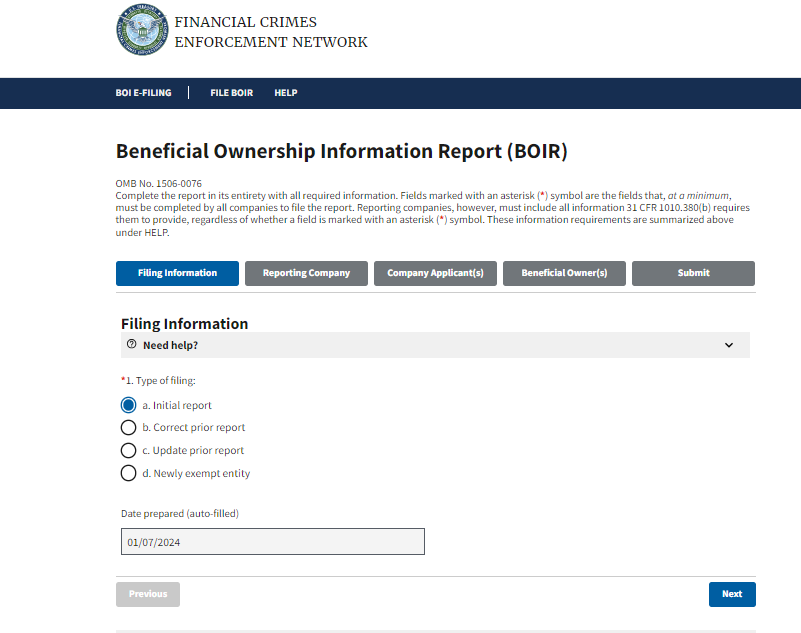

e) On the next page, the filling out of the form will begin. If this is your first time completing this report, select option A and click the Next button.

A “Need help?” bar appears in each section of this form. At the top of each question, it shows the meaning of each option. If you have any questions, click on it and more information will appear.

Step 5: Submit the Beneficial Ownership Information Report (BOIR)

The last step is to submit the completed Beneficial Ownership Information Report form by clicking the “Submit BOIR” button. A confirmation page will then appear. Be sure to download a transcript of the form to save a copy for your records by clicking the “Download Transcript” button at the bottom of the page.

CONCLUSION

Your BOI report is key component to maintaining transparency and compliance for your small business and/or LLC. Take action soon, as failure to report could lead to several fines and legal consequences for you and your business.

Consult with the experts! Contact Attorney Marcos, an experienced business attorney who can make the process of filing the Beneficiary Ownership Information Report (BOIR) a breeze. Your business deserves the best, and you deserve peace of mind! Contact us at (480) 324-6378 or email us at [email protected].