If you are a business owner, take some time to understand grants. Many of our clients ask: What are grants for small businesses? We are happy to answer this question, clarify their doubts, and educate them on the important opportunities companies can access. Let’s be clear. A grant is not free money since you need to know how to navigate the process.

What are Grants?

Grant money is given by federal, state, county, or local governments, private firms, or corporations to an individual, business, nonprofit organization, or corporation. Grants are a fantastic source of small business funding to help your business grow, reach a particular goal, or complete a project. Moreover, you also may need to follow the grant guidelines.

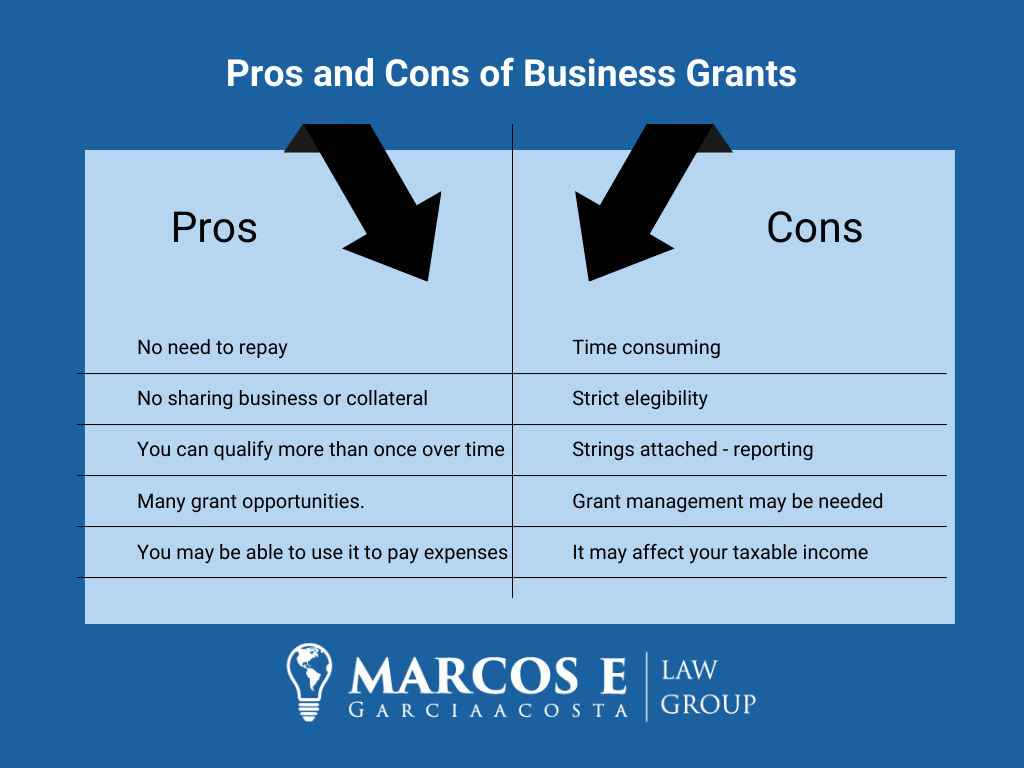

Grants bring money you won’t repay and won’t incur interest or high fees. Some guides and rules may dictate how the funds can be used, but noncompliance issues are limited if you stick to the guidelines.

It is essential to understand grant money is meant to be expended and invested in your business. Theoretically, you should not pay taxes on the grant money because the purpose of the grant is to be disbursed by paying for goods or services for your business, but most grants are counted as income. To be a successful grantee requires having good accounting practices to back up your expenses. Tracking and recording all costs, even the small ones, is necessary.

Researching for grants and applying for funding requires time and work, but the effort may be worthwhile. If you successfully get a grant for your business, startup, or project, your operations may be propelled to the next level.

What business grants aren’t

It would be best if you didn’t confuse business grants with loans. Both grant and loan money are provided to businesses needing funding, but grant recipients don’t need to pay back. In contrast, business borrowers have to pay back loans within a certain period and have interest rates.

Another difference is that businesses acquire loans from lenders, such as banks. Grantees can apply through various resources, like the government, corporations, or grant organizations.

Business grants and donations aren’t the same thing. Although both may provide funding, grants generally need to fill applications and fit spending restrictions and must be approved by the grantor entity.

In most cases, a grant coordinator will be assigned to your project if you’ve been given a grant. The coordinator will ensure that the money is being used for the intention you stated when you applied for the funding.

Remember, grants are provided to fund a particular purpose. On the other hand, donations may be used in any way and are not tracked by the donors.

International Companies Taking Advantage of Grants in the USA

The availability to apply for a business grant is a consideration for international companies ready to set up operations in the USA.

Who is eligible, and where to find grants?

Eligibility for small business grants depends on the requirements of the funding agency, organization, or private entity. There are five main small business grant types:

- Nonprofit grants are abundant as these organizations usually don’t have other income sources. Find grants that match specific nonprofit objectives through GrantWatch.com.

- Government grants are available at the federal, state, and local levels. Often they have specific requirements for qualification. While state and local governments have smaller grants, these are less competitive than federal ones.

- Grants for immigrants and minorities are few, but you can find a list here. These grants help minorities and refugees to get the necessary business assistance.

- Grants for veterans. Eighteen million Americans are veterans in the USA, or 7% of the population. In almost a parallel, veterans own around 6% of U.S. businesses and employ about 4 million of their fellow Americans, according to the U.S. Census Bureau. Here you’ll find a list of small business grants for veterans.

- Grants for women help some of the 42% of women-owned businesses in the United States. Women are starting businesses at record rates, especially Hispanic women, and with limited access to venture funding, grants are an excellent option for women in business. Explore opportunities by following this link.

Our firm, Marcos E. Garciaacosta Law Group, educates entrepreneurs about available resources to develop and grow. We are sharing a Google doc with a list of grants worth exploring.

If you get a grant, please share your experiences with us by calling (480) 324-6378